does texas have inheritance tax 2021

The short answer is no. However most estates are exempt from this tax.

New 2021 Upcoming Changes To Estate Planning And Probate

Fortunately Texas Is One Of The 33 States That Does Not Have An.

. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. If the inheritance tax is paid within nine months of date of decedents death a 5 percent discount is allowed.

The top estate tax rate is 16 percent exemption threshold. Or have Inheritance and Estate Tax forms mailed to you contact the Inheritance and Estate Tax Service. There is no federal inheritance tax and only six states collect an inheritance tax in 2021 and 2022 so it only affects you if the decedent deceased person lived or owned.

Regardless of the size of your estate you wont owe estate taxes to the state of Texas. For 2020 and 2021 the top estate-tax rate is 40. Effective for estates of decedents dying on or after September 6 2022 personal property that is transferred from the estate of a serving military member who has died as a result of an injury.

The Inheritance Tax charged will be 40 of 175000 500000 minus 325000. The federal estate tax generally applies to assets over 1206 million in 2022 and 1292 million in 2023. Only estates above 1117 million in 2021 will have to deal.

Texas does not have state estate taxes but Texas is subject. The tax due should be paid when the return is filed. There is no federal inheritance tax but there is a federal estate tax.

However in texas there is no such thing as an inheritance tax or a gift tax. The estate can pay Inheritance Tax at a reduced rate of 36 on some assets if you leave 10 or more of the. The big question is if there are estate taxes or inheritance taxes in the state of Texas.

Inheritance Tax Laws in Texas. Twelve states and washington dc. The federal estate tax only.

The state of Texas does not have any inheritance of estate taxes. For 2021 the IRS estate tax exemption is 117. There are not any estate or inheritance taxes in the state of.

Inheritance tax also called the estate tax or death tax is levied at both the federal level and state level and applies to any assets transferred to. There is a 40 percent federal tax. However this is only levied against estates worth more than 117 million.

As of 2019 only twelve states collect an inheritance tax. No estate tax or inheritance tax. There is a 40 percent.

However if the beneficiarys net. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Texas does not have an inheritance tax.

Inheritance taxes in Texas. Fortunately Texas doesnt have an estate tax and is one of the dozens of states without it. The federal government has an estate tax and some states also have this tax.

Connecticut has an estate tax ranging from 108 to 12 with an annual exclusion amount of 71 million in 2021. You might owe money to the federal government though.

Estate Tax Texas Aglaw Blog Towntalk Radio

:focal(0x0:3000x2000)/static.texastribune.org/media/files/d1e98fb8f28a8457df679192b4fa976b/2022Elections-glossary-leadart-v1.png)

Texas Governor Lieutenant Governor And More What Do These Offices Do The Texas Tribune

Does Texas Have An Inheritance Tax Rania Combs Law Pllc

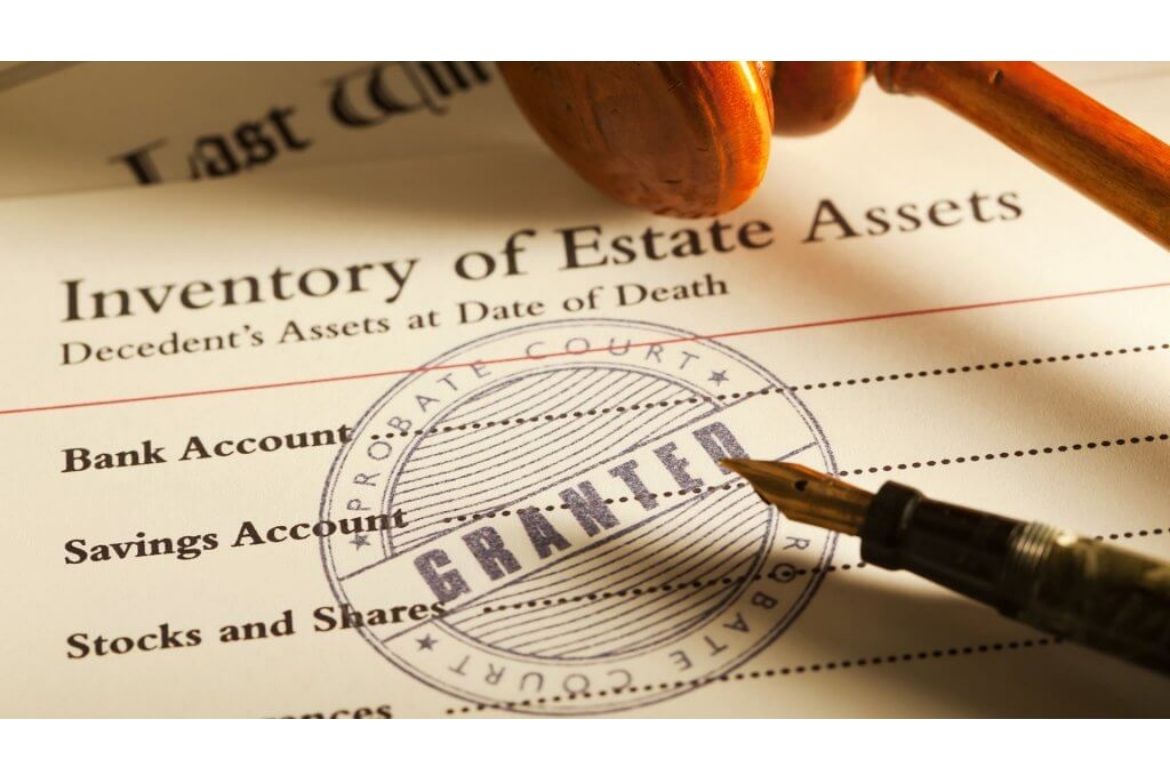

Texas Inheritance Tax Forms 17 106 Return Federal Estate Tax Credi

Does Your State Have An Estate Or Inheritance Tax

Texas Estate Tax Everything You Need To Know Smartasset

Michael Cohen Dallas Elder Lawyer Assets Attorney Benefits Care Deeds Elder Estate Firm Lady Bird Law Lawyer Living Medicaid Planning Poa Power Of Attorney Probate Protect Protection Social Security Trusts Va

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

Inheritance Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

:max_bytes(150000):strip_icc()/Inheritance_Tax_Final-0c412b7f515f4d9aa7d7489b3f8b02fc.png)

Inheritance Tax What It Is How It S Calculated And Who Pays It

How Do State Estate And Inheritance Taxes Work Tax Policy Center

How To Obtain Letters Testamentary In Texas Ryan Reiffert Pllc

Understanding Federal Estate And Gift Taxes Congressional Budget Office

2021 Top Tax Accounting Firms Texas Cpa Firm

Is An Inheritance Taxable In Texas

Fact Sheet California S Gun Safety Policies Save Lives Provide Model For A Nation Seeking Solutions California Governor

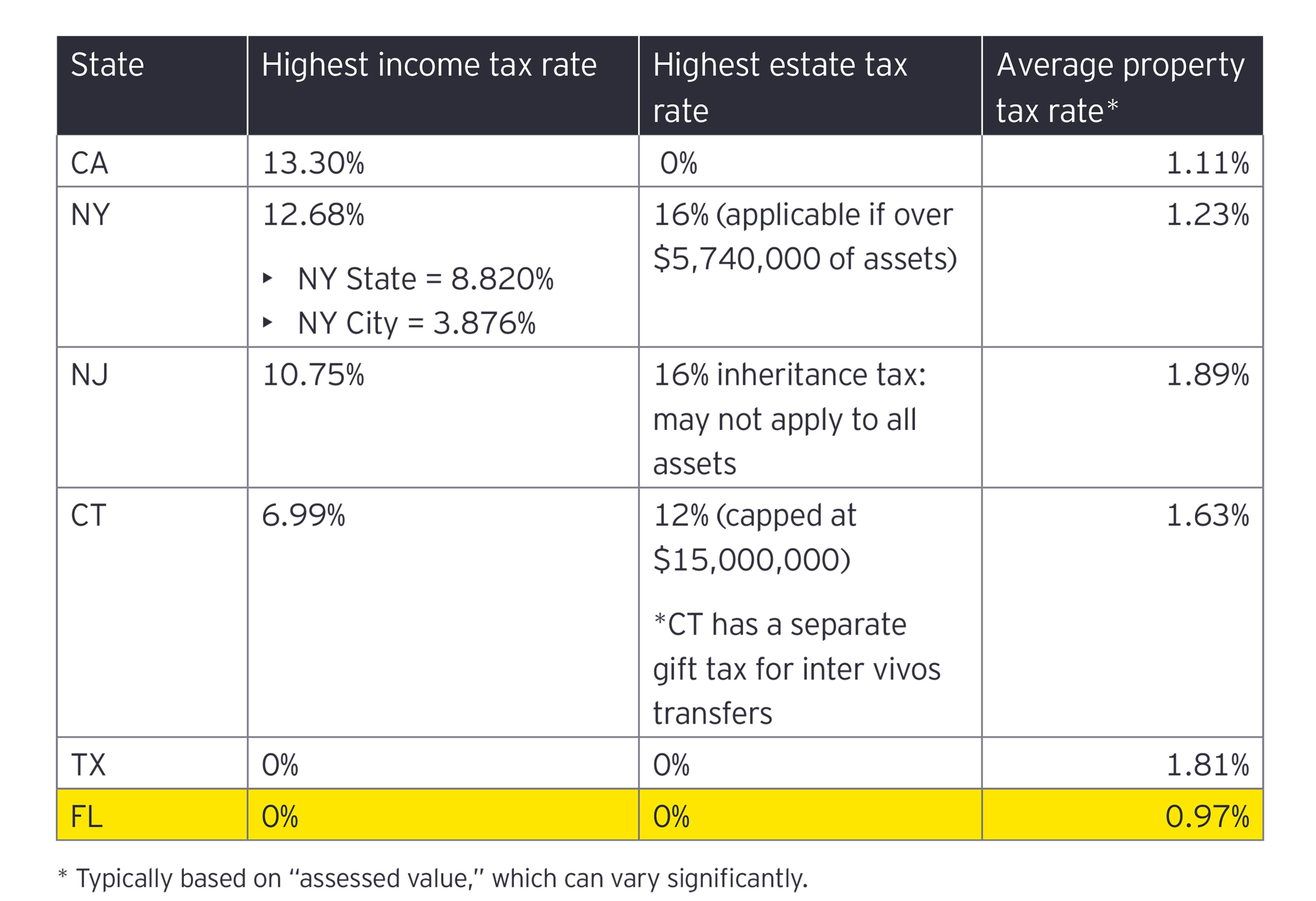

Tax Considerations When Moving To Florida Ey Us

Determining If Estate Taxes Apply To A Texas Property Houston Estate Planning And Elder Law Attorney Blog August 24 2021

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)